Get Your Dream Smartphone in 10 minutes.

No bank account needed

Why Choose Credithive?

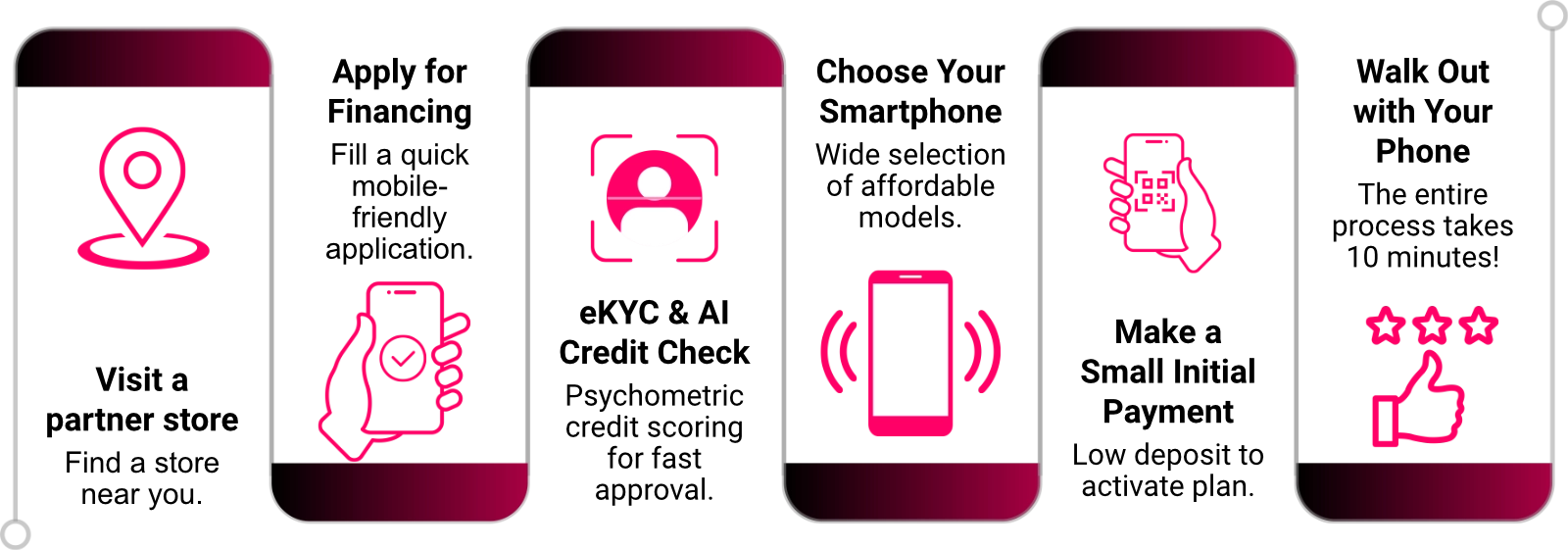

How Credithive works

STEP-BY-STEP GUIDE

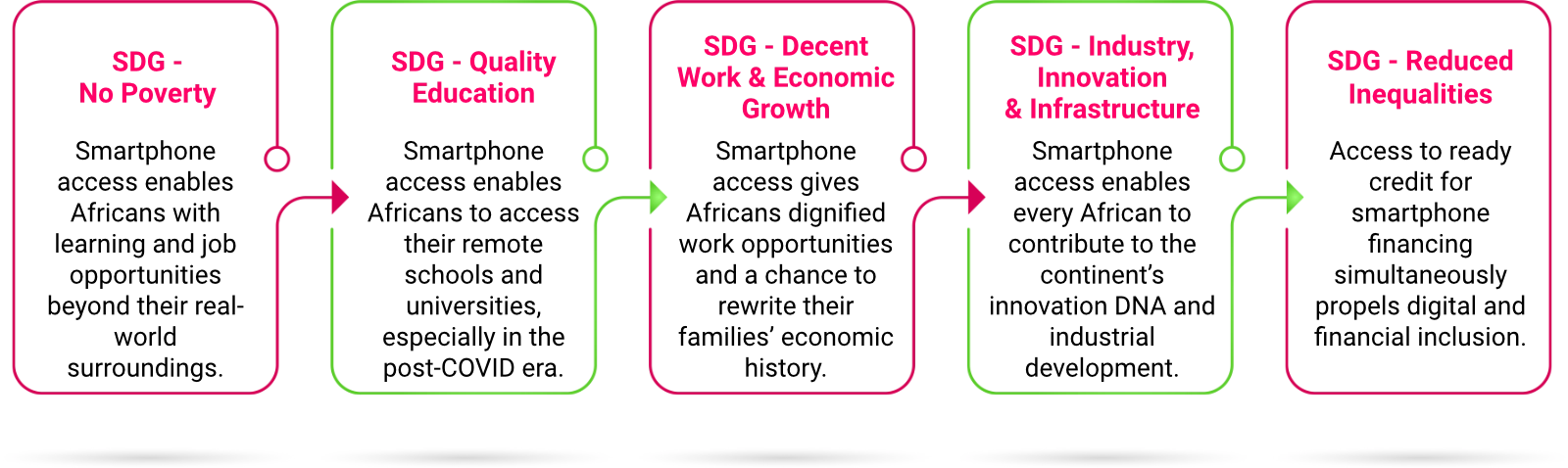

Impact

Smartphone Financing - Impact

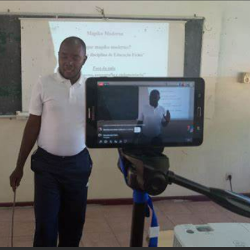

Smartphone financing enables true digital and financial inclusion for every African.

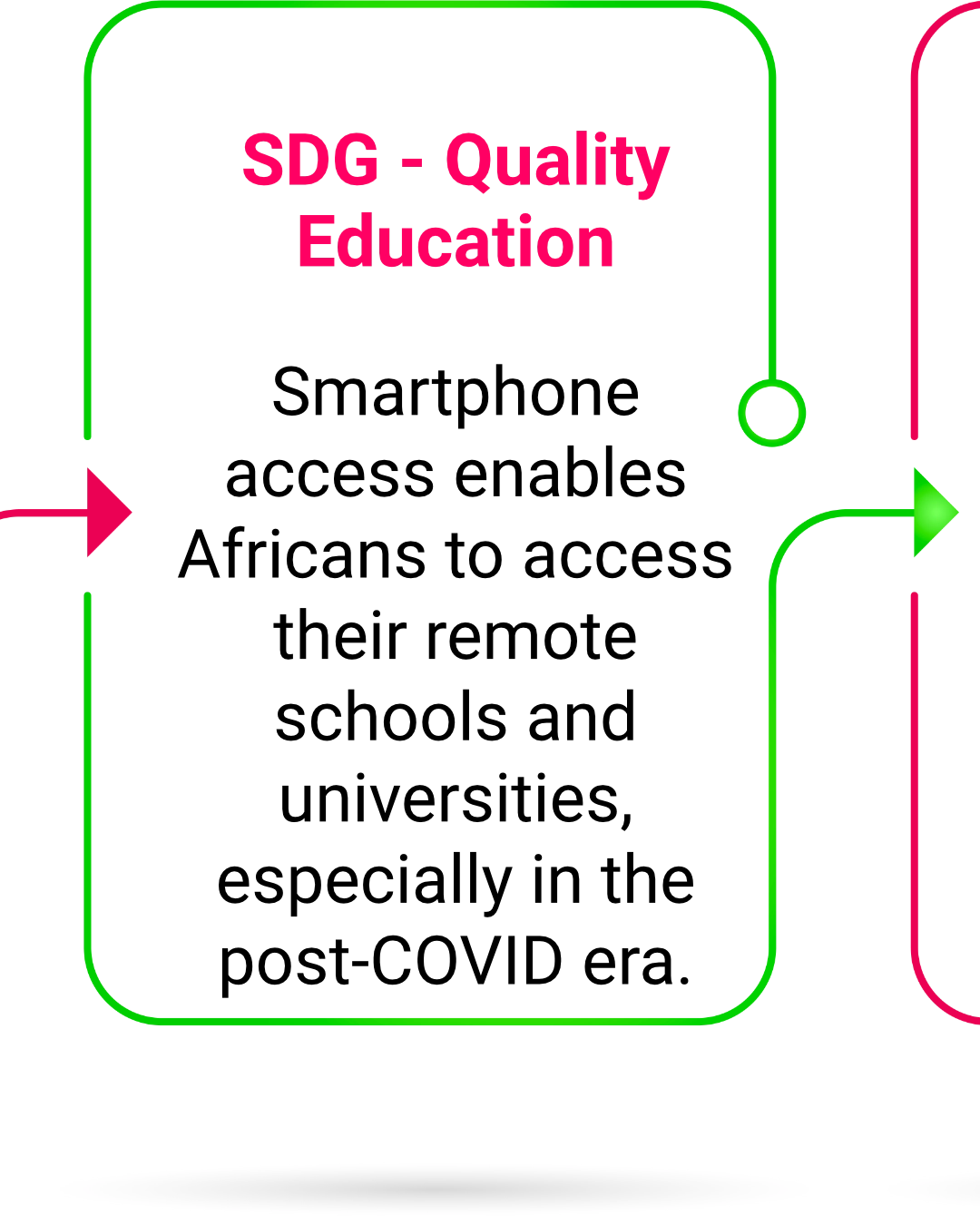

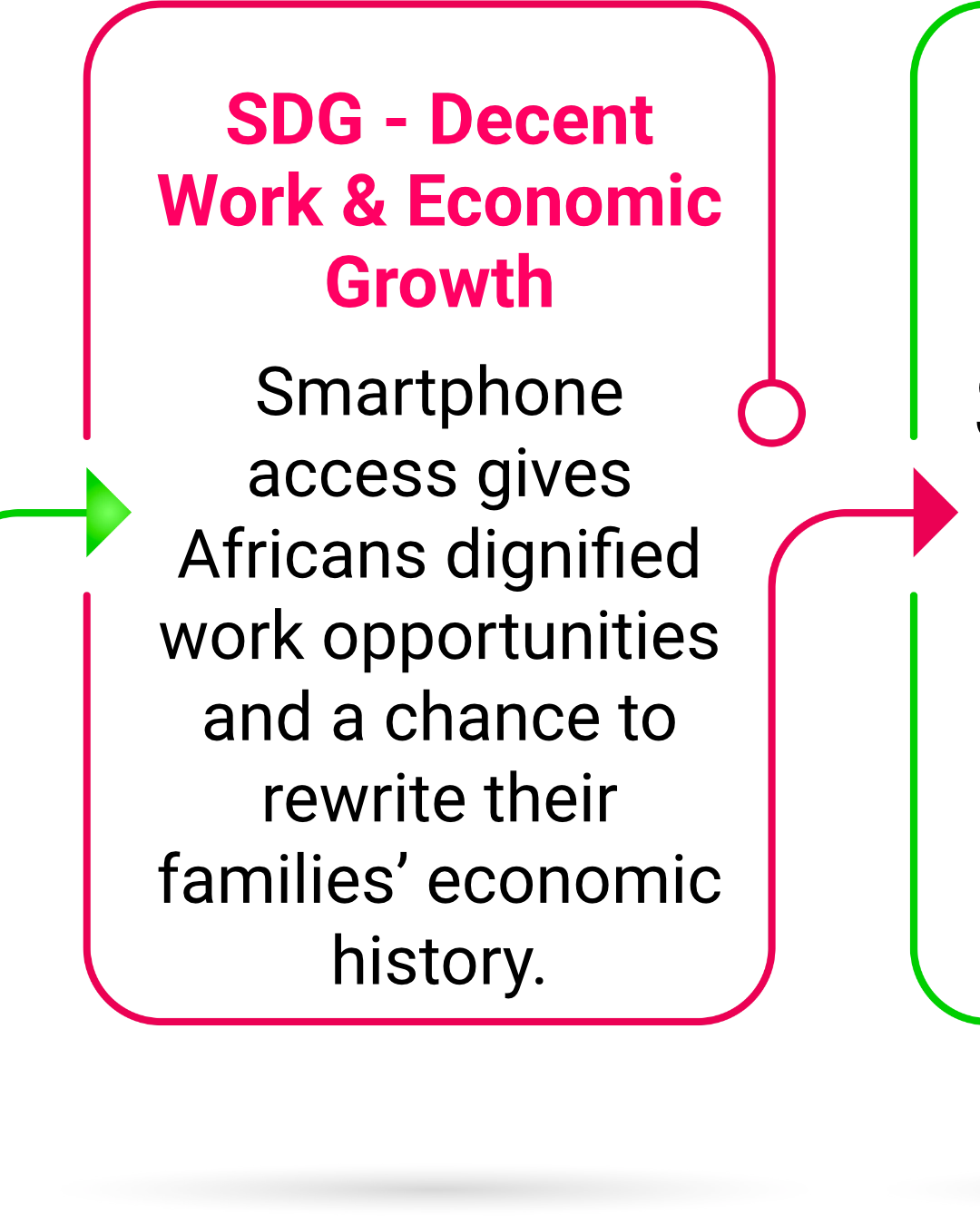

CreditHive’s Smartphone Financing Solution aligns with 5 out of 17 UN SDGs.

CUSTOMER STORIES

Testimonials

Get in Touch with us

+44 7932 459922Frequently Asked Questions

1. Who can apply for smartphone financing?

Anyone who meets the following criteria can apply for smartphone financing:

✅ Must be at least 18 years old

✅ Have a valid government-issued ID

✅ Provide proof of residence (utility bill, lease agreement, etc.)

✅ Have a mobile money wallet or an active payment method

✅ Have a steady source of income or demonstrate repayment ability

2. What documents are required for approval?

To apply for smartphone financing, you will need:

📌 A valid government-issued ID (e.g., passport, national ID, or driver’s license)

📌 Proof of residence (utility bill, lease agreement, or official letter)

📌 A working mobile number linked to a mobile money wallet

3. How long does the approval process take?

The approval process is quick and seamless!

If all documents are correctly submitted, approval is instant in most cases.

4. What are the repayment options?

💳 You can make your repayments through:

✔ Mobile Money Services (EcoCash, MTN Money, Airtel Money, etc.)

✔ Partner Retail Stores – Pay in cash at authorized outlets

✔ Bank Transfers (if available in your country)

5. Can I pay off my phone early?

Yes! You can clear your remaining balance anytime without any penalties. Paying off your phone early may also improve your eligibility for future financing.

6. What happens if I miss a payment?

If you miss a payment, the following may happen:

⚠️ Reminder SMS – You will receive a notification to make the payment.

🔒 Phone Locking – Your device may be remotely locked until payment is made.

📉 Credit Impact – Your credit profile may be affected, making future financing difficult.

📞 Collection Calls – Our recovery team may contact you for payment.

⚖️ Legal Action – Continued non-payment may result in legal recovery procedures.

CreditHive - Easy Smartphone Credit

2025-12-05 17:29:20

When customers come back, everything grows. CreditHive’s power-bank campaign didn’t just reward users, it delivered a 110% jump in sales across our key markets. Loyal customers are becoming our strongest engine for expansion. {hashtag|#|CreditHive} {hashtag|#|GrowthStory} {hashtag|#|InvestorReady} {hashtag|#|HighGrowth} {hashtag|#|MarketExpansion} {hashtag|#|110PercentGrowth} {hashtag|#|ScalingUp} {hashtag|#|EmergingMarkets} {hashtag|#|FintechInvestment} {hashtag|#|ImpactGrowth}

CreditHive - Easy Smartphone Credit

2025-09-15 17:50:22

🌐 Beyond Smartphones: Building Africa’s Digital Credit Ecosystem 🚀 At CreditHive, we know that a smartphone is just the beginning. What truly matters is the digital identity, credit history, and opportunities it unlocks for millions of unbanked users. Here’s how we’re taking inclusion to the next level: ✅ Digital Credit Profiles — Every repayment builds trust and history ✅ AI-Powered Risk Models — Smarter lending with lower defaults ✅ Financial Ecosystem Linkages — From mobile banking to e-commerce, education, and healthcare ✅ Partnership-Driven Growth — Collaborating with telcos, fintechs, and governments 📈 Our mission is simple: turning first-time smartphone ownership into lifelong financial empowerment. Together, we’re not just financing devices, we’re financing possibilities. 📩 Investors, telcos, and ecosystem partners, let’s connect to scale Africa’s next wave of digital inclusion. {hashtag|#|CreditHive} {hashtag|#|DigitalAfrica} {hashtag|#|FinancialInclusion} {hashtag|#|FintechInnovation} {hashtag|#|SmartphoneFinancing} {hashtag|#|AfricaRising} {hashtag|#|DigitalIdentity} {hashtag|#|CreditEcosystem} {hashtag|#|TechForGood} {hashtag|#|ImpactInvestment}

CreditHive - Easy Smartphone Credit

2025-09-04 16:52:42

Credithive Expansion in DRC Driving Growth and Digital Inclusion Smartphones aren’t a luxury anymore — they’re a lifeline. Yet for millions in DRC, high costs keep them offline. That’s why CreditHive is expanding with new stores across the country. 💛 We’re making smartphones affordable through simple instalment plans, giving more people access to: 📱 Education & e-learning 💼 Entrepreneurship & business growth 💳 Mobile money & fintech 🌍 Global connectivity This isn’t just about phones — it’s about digital inclusion powering economic growth. Every device financed fuels DRC’s digital economy, creates jobs, and opens doors to new opportunities. At CreditHive, we believe access = empowerment. The next billion digital users are waiting, and we’re proud to be part of their journey. 🔗 Learn more: www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|DigitalInclusion} {hashtag|#|FinancialInclusion} {hashtag|#|SmartphonesMadeAffordable} {hashtag|#|DRC} {hashtag|#|AfricaGrowth} {hashtag|#|Fintech} {hashtag|#|EmpoweringCommunities}

CreditHive - Easy Smartphone Credit

2025-08-30 15:08:31

🎉 Big News from CreditHive! 🎉 We are excited to announce the opening of our new Orange store in Lubumbashi, DRC 🇨🇩! Through this partnership with Orange, CreditHive will now bring affordable smartphone financing directly to customers in-store. This means more people can: 📱 Own the latest smartphones 💳 Pay in simple, flexible instalments 🌍 Unlock access to digital opportunities This expansion marks another step in our mission to drive financial inclusion and digital access across Africa. If you’re in Lubumbashi, visit our new Orange store today and experience the smart, affordable way to own your dream phone with CreditHive. ✨ Together, we’re powering Africa’s digital future! {hashtag|#|CreditHive} {hashtag|#|Orange} {hashtag|#|Lubumbashi} {hashtag|#|DRC} {hashtag|#|FinancialInclusion} {hashtag|#|DigitalAfrica} {hashtag|#|SmartphoneOnCredit}

CreditHive - Easy Smartphone Credit

2025-08-28 12:39:41

Leadership in Fintech: Driving Africa’s Digital Inclusion In today’s world, access to a smartphone is no longer a luxury—it’s a lifeline. From education to healthcare, from mobile banking to entrepreneurship, digital access defines opportunity. Yet, for millions of people across Africa, this door remains closed simply because affordable financing isn’t available. At CreditHive, we are not just building a business—we are building bridges to inclusion. 💡 By offering smartphone financing to the unbanked, we are empowering individuals to connect, learn, and grow. 💡 By partnering with mobile operators and OEMs, we are accelerating smartphone penetration across emerging markets. 💡 By enabling investors to participate, we are shaping an ecosystem where profitability and social impact go hand in hand. True leadership in fintech is about more than technology—it’s about vision, responsibility, and courage to reimagine possibilities. The future of Africa’s digital economy depends on inclusion first, and we’re proud to be leading that change. 📈 The next billion users are waiting. The question is: who will help unlock their potential? We at CreditHive are ready—and we invite visionary investors and partners to join us in making this transformation a reality. {hashtag|#|Leadership} {hashtag|#|Fintech} {hashtag|#|FinancialInclusion} {hashtag|#|CreditHive} {hashtag|#|ImpactInvestment} {hashtag|#|AfricaRising} {hashtag|#|DigitalEconomy}

CreditHive - Easy Smartphone Credit

2025-08-19 16:22:10

🌍 Fueling Africa’s Digital Economy with New Partnerships 📱✨ At Credithive, our mission is simple yet powerful — to make smartphones affordable and accessible for everyone, especially the unbanked. Every new device financed is more than just a phone — it’s a tool for education, financial inclusion, entrepreneurship, and progress. We’re thrilled to share that Credithive is entering into new partnerships with leading telecom operators across multiple African countries. These tie-ups will not only expand our reach but also strengthen Africa’s digital economy by: ✅ Enabling millions of people to own their first smartphones on easy credit. ✅ Supporting telecom operators in driving higher connectivity and data adoption. ✅ Opening doors for new opportunities in e-commerce, fintech, education, and healthcare. This is just the beginning. With every partnership, we’re building a stronger, more connected Africa — where digital inclusion powers economic growth. 💡 Investors, telecom leaders, and stakeholders — now is the time to be part of this transformation. Together, we can unlock Africa’s true digital potential. {hashtag|#|Credithive} {hashtag|#|DigitalAfrica} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|Partnerships} {hashtag|#|Telecom} {hashtag|#|AfricaGrowth}

CreditHive - Easy Smartphone Credit

2025-08-12 18:13:29

🌍 CreditHive is Now Live in Sierra Leone! 🇸🇱📱 We’re excited to share that CreditHive has officially launched in Sierra Leone — a significant milestone in our mission to make smartphone ownership possible for everyone. In today’s world, access to a smartphone is more than just convenience — it’s a gateway to education, business, communication, and financial inclusion. Yet, for many, the upfront cost remains a barrier. CreditHive is here to change that. 💡 What we offer in Sierra Leone: ✅ Flexible daily, weekly, and monthly payment plans ✅ A fast, transparent approval process ✅ Solutions designed for unbanked and underbanked customers ✅ The chance to connect, learn, and grow through digital access By enabling more people to own smartphones, we’re not just selling devices — we’re unlocking opportunities, connecting communities, and driving digital inclusion. A big thank you to our local partners, teams, and early customers who are already part of this journey. Together, we’re building a more connected Sierra Leone. 📲 Learn more about Credithive: https://credithive.co.uk/ {hashtag|#|Credithive} {hashtag|#|DigitalInclusion} {hashtag|#|SierraLeone} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|AfricaTech} {hashtag|#|EmpoweringCommunities}

CreditHive - Easy Smartphone Credit

2025-08-07 17:19:51

Powering Progress with People – CreditHive Monthly Briefing in Ghana 🇬🇭 At CreditHive, we believe that empowered teams deliver exceptional impact. Our recent Monthly Briefing with Supervisors in Ghana was more than just an update — it was a celebration of progress, learning, and leadership. 📌 The session focused on: • Reviewing last month’s achievements and learnings • Aligning on our mission to expand credit access • Reinforcing service excellence for our customers To appreciate the relentless dedication of our field teams, we also distributed Jackets to all our supervisors. A small token of appreciation — but a big symbol of unity, trust, and the brand they proudly represent every day. 🌍 As we continue to grow in Ghana and across Africa, we remain committed to building strong, motivated teams that drive financial inclusion at the grassroots. Thank you to our Ghana team — your work is the heartbeat of our mission! {hashtag|#|CreditHive} {hashtag|#|GhanaTeam} {hashtag|#|DigitalFinance} {hashtag|#|TeamRecognition} {hashtag|#|MonthlyBriefing} {hashtag|#|FinancialInclusion} {hashtag|#|AfricaRising} {hashtag|#|EmpoweringCommunities} {hashtag|#|CredithiveAfrica}

CreditHive - Easy Smartphone Credit

2025-08-05 15:06:32

🌍 Africa's Digital Economy is Rising — And CreditHive is Helping Fuel the Momentum Africa is undergoing a digital transformation — driven by mobile connectivity, fintech innovation, and a young, tech-savvy population. However, access to affordable devices and financial inclusion remains a challenge for millions across the continent. At CreditHive, we’re proud to be part of the solution. ✅ By offering smartphones on flexible credit plans, ✅ Enabling daily and weekly payment options, ✅ Partnering with leading telecom providers, ✅ And building a robust digital ecosystem for the unbanked and underserved, —we’re helping more Africans get connected, access digital services, and unlock new opportunities in education, business, and communication. 📱💡 A connected phone is no longer a luxury — it's a lifeline. Together, we're building a future where digital inclusion powers economic progress. {hashtag|#|DigitalAfrica} {hashtag|#|FinancialInclusion} {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|DigitalEconomy} {hashtag|#|TechForGood} {hashtag|#|AfricaRising} {hashtag|#|Fintech} {hashtag|#|ImpactInvesting}

CreditHive - Easy Smartphone Credit

2025-08-04 12:09:56

📣 Exciting News from CreditHive! We’ve launched Daily and Weekly Payment Plans in Ghana 🇬🇭 to empower the unbanked. At CreditHive, we believe that access to technology is a right, not a privilege — and smartphones are essential tools for education, income generation, and digital inclusion. Recognizing the diverse financial needs of our customers, we’re proud to introduce flexible daily and weekly payment plans to make smartphone ownership easier and more accessible than ever before. 💡 What This Means for Customers: ✔️ Daily or weekly repayment flexibility — no more pressure of monthly instalments ✔️ Zero bank account requirement — tailored for the unbanked and underserved ✔️ Fast, paperless onboarding through the CreditHive app ✔️ Build a digital credit profile while staying connected ✔️ Own your dream device with a small upfront cost 🌍 Why Ghana? Ghana is one of Africa’s fastest-growing digital economies. Yet, millions remain excluded from formal financing. With this launch, CreditHive takes another step forward in bridging the digital divide and empowering communities across the country. 💬 Let’s Connect: Are you an investor, telecom operator, or tech partner interested in driving digital inclusion in Africa? Let’s explore how we can work together to scale this impact. {hashtag|#|CreditHive} {hashtag|#|GhanaLaunch} {hashtag|#|SmartphoneOnCredit} {hashtag|#|DigitalInclusion} {hashtag|#|FintechAfrica} {hashtag|#|Unbanked} {hashtag|#|TechForGood} {hashtag|#|FinancialInclusion} {hashtag|#|ImpactInvesting}

CreditHive - Easy Smartphone Credit

2025-08-01 20:23:20

CreditHive launches Daily & Weekly Payment Plans in Ghana!🇬🇭 We’re excited to launch Daily & Weekly Payment Plans designed to make smartphone ownership easier, especially for the unbanked. * Choose your plan: Daily, Weekly, or Monthly * 100% paperless onboarding * Low upfront cost Together, let’s empower Ghana’s digital future one phone at a time. Looking to partner? Let’s drive financial inclusion across Africa. www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|DigitalInclusion} {hashtag|#|Ghana} {hashtag|#|Fintech} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialAccess} {hashtag|#|InclusiveGrowth} {hashtag|#|AfricaTech} {hashtag|#|TechForGood} {hashtag|#|InnovationInAfrica} {hashtag|#|Unbanked} {hashtag|#|DigitalAfrica} {hashtag|#|MobileFinance} {hashtag|#|FintechAfrica} {hashtag|#|ImpactDriven} {hashtag|#|StartupAfrica} {hashtag|#|FintechInnovation} {hashtag|#|AfricaRising} {hashtag|#|MobileEconomy} {hashtag|#|EmpowerWithTech} {hashtag|#|ConnectivityForAll}

CreditHive - Easy Smartphone Credit

2025-07-26 22:54:54

🌍 CreditHive is launching soon in Sierra Leone! 🚀 We’re excited to announce that CreditHive is expanding its footprint across Africa — and next stop is Sierra Leone! 🇸🇱 At CreditHive, our mission is to empower lives through accessible smartphone financing, helping individuals and communities stay connected, grow digitally, and unlock new opportunities — all through easy, affordable credit. With flexible payment options, a seamless mobile experience, and trusted partnerships, we’re bringing financial inclusion to the forefront of Africa’s digital revolution. 📱 New devices. 💸 Easy credit terms. ✨ Big dreams, made possible. Stay tuned as we get ready to roll out — Sierra Leone, we're coming with innovation, inclusion, and impact! {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|SierraLeone} {hashtag|#|DigitalAfrica} {hashtag|#|TechForGood} {hashtag|#|InvestInAfrica} {hashtag|#|AfricaRising} {hashtag|#|Fintech} {hashtag|#|CredithiveInSierraLeone} {hashtag|#|AffordableTechnology} {hashtag|#|UnlockPossibilities}

CreditHive - Easy Smartphone Credit

2025-07-22 18:14:43

At CreditHive, we’re on a mission to make digital inclusion a reality for all. We believe that access to smartphones is the gateway to education, entrepreneurship, and economic empowerment. That’s why we’re building a bridge — not just with technology, but with trust. 📱 Through our affordable credit solutions, we’re helping thousands across Africa own smartphones, build credit history, and unlock opportunities once out of reach. 🤝 With strong partnerships across major telecoms and local agents, we’re not just selling phones — we’re enabling futures. CreditHive isn’t just a fintech company. It’s a movement to uplift lives, one device at a time. Join us in shaping a connected, inclusive future for Africa. {hashtag|#|DigitalInclusion} {hashtag|#|FintechAfrica} {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|ImpactInvestment} {hashtag|#|FinancialInclusion} {hashtag|#|AfricaRising}

CreditHive - Easy Smartphone Credit

2025-07-16 16:16:36

Africa’s digital future is calling are you ready to answer? CreditHive isn’t just financing smartphones we’re building credit history, identity, and opportunity for millions. Why partner with us? 25% smartphone market growth by 2026 EMI-based recurring revenue First-mover advantage across credit, telco & fintech Scalable, cloud-native tech Smart credit engine = lower defaults Goal: Finance 50M smartphones by 2030. Let’s unlock growth together. www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|DigitalAfrica} {hashtag|#|ImpactInvestment} {hashtag|#|SmartphoneFinancing} {hashtag|#|AfricaRising} {hashtag|#|Fintech} {hashtag|#|TechForGood} {hashtag|#|InvestorOpportunity} {hashtag|#|InclusiveGrowth} {hashtag|#|DigitalInclusion} {hashtag|#|Zambia} {hashtag|#|SubSaharanAfrica} {hashtag|#|FutureReady} {hashtag|#|StartupAfrica} {hashtag|#|FintechInnovation} {hashtag|#|EMISolutions} {hashtag|#|FinancialInclusion}

CreditHive - Easy Smartphone Credit

2025-07-11 15:04:41

Customer-Centric Innovation in Action! At the MTN Zambia Trade Fair, CreditHive had the privilege to engage directly with our users and the insights were invaluable. ✅ Strong engagement ✅ Incredible response to our financing solution ✅ Real conversations that drive real progress We’re grateful to every customer who visited, shared feedback, or joined the CreditHive family. Together, we’re building a more inclusive digital future one phone at a time. {hashtag|#|CreditHive} {hashtag|#|CustomerFirst} {hashtag|#|DigitalInclusion} {hashtag|#|MTNZambia} {hashtag|#|FintechAfrica} {hashtag|#|SmartphoneFinancing} {hashtag|#|TechForGood}

CreditHive - Easy Smartphone Credit

2025-07-08 18:01:45

Smartphone Financing Made Simple with CreditHive! 📱💡 At CreditHive, we’ve built more than just an app — we’ve created a seamless digital journey that puts access to technology in every hand, especially for the underserved and unbanked. ✅ Simple Onboarding — Intuitive interface with quick registration 📸 One-Click eKYC — Scan documents, click a picture, and you’re verified 💰 Instant Credit Approval — Fast decisions with our smart credit profiling engine 🛍️ Easy Purchase & Payments — Choose your phone and pay in flexible instalments 📲 Track Everything in One Place — Status updates, payment reminders, and support — all in-app! We’ve made smartphone ownership easy, accessible, and affordable for everyone — because technology is not a luxury, it’s a necessity. Join us in powering digital inclusion across Africa. 🌍 📈 Transforming lives, one smartphone at a time. {hashtag|#|CreditHive} {hashtag|#|FintechAfrica} {hashtag|#|InclusiveFinance} {hashtag|#|MobileFirst} {hashtag|#|SmartphoneFinancing} {hashtag|#|DigitalTransformation} {hashtag|#|TechForAll} {hashtag|#|UnbankedToEmpowered} {hashtag|#|EaseOfAccess} {hashtag|#|CreditHiveApp}

CreditHive - Easy Smartphone Credit

2025-07-04 20:19:34

Our Technology, Their Growth Seamless onboarding. Real-time verification. Smart credit profiling. Our team has built a lightweight, mobile-first financing engine that helps unbanked users get approved in minutes — with no bank account required. ✅ eKYC made simple ✅ Psychometric-based credit scoring ✅ Transparent payment tracking ✅ Zero paperwork, 100% accountability CreditHive’s technology is scalable, field-tested, and now live in 6 countries — and we’re just getting started. 🔍 Investors & partners — let’s talk growth, scale, and impact. {hashtag|#|FintechInnovation} {hashtag|#|AfricaTech} {hashtag|#|CreditHive} {hashtag|#|InclusiveFinance} {hashtag|#|ScalableSolutions} {hashtag|#|TelecomPartnerships}

CreditHive - Easy Smartphone Credit

2025-07-01 21:01:43

CreditHive: Powering Africa’s Digital and Financial Transformation 🌍📱 What began as a bold idea to bridge the digital divide for the unbanked in Africa has now evolved into a fast-growing fintech force transforming lives across multiple countries. Our Journey So Far: Started with a mission: Make smartphones accessible to those without traditional banking. Launched in Ghana, Zambia, Zimbabwe, Sierra Leone, Malawi & DRC Congo. Partnered with major telecom players like Africell, Orange, and Econet. Enabled thousands of unbanked customers to own smartphones through flexible financing and smart credit profiling. Achieved high repayment rates through psychometric analysis and agent-led onboarding. 🌍 Current Impact: Over 50,000 smartphones financed with <10% default in mature markets. Localised agent networks and digital tools built for real-time sales and risk tracking. Proven trust among underserved populations through transparent, tech-led processes. Strong partner ecosystem across telcos, retailers, and field networks. 🔮 Our Vision for the Future: Expand into 5+ African countries in the next 18 months. Launch AI-powered credit scoring to increase approval rates while reducing risk. Deepen partnerships with MNOs and OEMs to offer bundled services. Build CreditHive into the most trusted consumer credit brand for Africa’s next billion users. 💡 We’re now actively engaging with strategic investors who believe in the power of financial inclusion, technology-led growth, and scalable impact. 👉 Let's shape the future of digital finance in Africa—together. {hashtag|#|CreditHive} {hashtag|#|FintechAfrica} {hashtag|#|InvestorOpportunity} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|ImpactInvesting} {hashtag|#|AfricaTech} {hashtag|#|DigitalCredit} {hashtag|#|InclusiveFinance} {hashtag|#|EmergingMarkets}

CreditHive - Easy Smartphone Credit

2025-06-25 11:37:50

✨ Giving Wings to Dreams with CreditHive! ✨ At CreditHive, we believe a smartphone is more than just a device — it's a gateway to opportunity. From students accessing online education to entrepreneurs managing their business, our customers are upgrading their lifestyle and unlocking their full potential. 📱 Access to Technology 💼 Support for Small Businesses 📚 Empowering Education 🌍 Bridging the Digital Divide Through affordable, flexible financing, we’ve helped thousands across Africa step into a smarter, more connected future. 🔓 No bank account? No problem. ⚡ Quick onboarding. Seamless experience. 💡 Real impact where it matters most. CreditHive is not just financing smartphones — we’re fueling ambition. 👉 Join us in building a digitally inclusive Africa. {hashtag|#|CreditHive} {hashtag|#|FinancialInclusion} {hashtag|#|DigitalAfrica} {hashtag|#|SmartphoneFinancing} {hashtag|#|TechForGood} {hashtag|#|EmpoweringDreams} {hashtag|#|UpgradeWithCreditHive} {hashtag|#|FintechImpact} {hashtag|#|LifestyleUpgrade}

CreditHive - Easy Smartphone Credit

2025-06-20 16:34:30

At CreditHive, Our People Power Our Progress In the heart of Africa’s rapidly growing digital economy, CreditHive is proving that a people-first culture and profitability go hand in hand. Here’s how we stand out: ✅ Employee-Centric: From flexible working models to continuous upskilling, we empower our teams across markets to lead with ownership and purpose. ✅ Locally-Driven Flexibility: Our decentralized model allows our teams in Ghana, Zambia, DRC, Zimbabwe & Guinea-Bissau and beyond to adapt quickly to local needs, boosting efficiency and outcomes. ✅ Profit with Purpose: CreditHive is not just growing; we’re thriving, with positive unit economics and increasing smartphone penetration among unbanked populations. We're proud of our journey—from launching in new regions to building agile and ambitious teams. To our future partners and investors: Let’s build inclusive, scalable fintech that changes lives and drives sustainable returns. {hashtag|#|CreditHive} {hashtag|#|EmployeeExperience} {hashtag|#|AfricaFintech} {hashtag|#|FinancialInclusion} {hashtag|#|InvestorReady} {hashtag|#|ScalableGrowth} {hashtag|#|TechForGood} {hashtag|#|FlexibleWork} {hashtag|#|ProfitWithPurpose} {hashtag|#|Unbanked} {hashtag|#|SmartphoneFinancing}

CreditHive - Easy Smartphone Credit

2025-06-16 17:23:29

Partnering for Progress: Telcos x CreditHive In a mobile-first continent like Africa, the smartphone is more than a device—it's a gateway to financial access, education, commerce, and opportunity. Yet, millions remain unconnected due to the high upfront cost of devices. At CreditHive, we’re changing this narrative through: 📱 Seamless smartphone financing tailored to the unbanked 📊 Data-driven credit profiling and psychometric analysis 🧠 Risk-managed onboarding via our embedded tech 🌍 Real-time insights on repayments, device usage & customer behavior 👥 Why It Matters for Telecoms: Increase device penetration & ARPU Reduce churn with long-term user commitments Tap into new customer segments across Tier 2/3 cities Enable digital inclusion and national tech growth goals We are already powering growth across Ghana, Zambia, Zimbabwe, DRC, and Guinea-Bissau — and we’re ready to scale further with forward-thinking telecom partners. 🤝 Let’s collaborate to bring smartphones into every hand, and opportunity into every home. 📩 Connect with us to explore partnership models: www.credithive.co.uk {hashtag|#|TelecomAfrica} {hashtag|#|SmartphoneFinancing} {hashtag|#|DigitalInclusion} {hashtag|#|TelcoGrowth} {hashtag|#|CreditHive} {hashtag|#|AfricaTech} {hashtag|#|DevicePenetration} {hashtag|#|FintechXTelco}

CreditHive - Easy Smartphone Credit

2025-06-13 17:33:43

🌍 CreditHive’s Vision: Empowering Africa, One Device at a Time 📱 At CreditHive, we believe financial access is a human right — not a luxury. Across Africa, millions remain unbanked, underserved, and excluded from digital progress. We’re here to change that. 🔹 By offering flexible, affordable smartphone financing, we empower: Entrepreneurs to run their businesses Students to access online learning Families to stay connected and informed 💡 Our Vision: To build a future where every African household has access to smart technology and the financial tools to grow with it. 📈 Operating in countries like Zimbabwe, Ghana, Guinea Bissau, Zambia, DRC, and more, we’re not just growing — we’re building an ecosystem of trust, inclusion, and opportunity. Join us on this mission to bridge the digital and financial gap in Africa. 🤝 Let’s create impact that lasts. {hashtag|#|CreditHive} {hashtag|#|VisionForAfrica} {hashtag|#|FinancialInclusion} {hashtag|#|SmartphoneFinancing} {hashtag|#|AfricaRising} {hashtag|#|TechForGood} {hashtag|#|DigitalInclusion} {hashtag|#|FintechAfrica} {hashtag|#|EmpowermentThroughAccess} {hashtag|#|InvestorOpportunity}

CreditHive - Easy Smartphone Credit

2025-06-11 12:53:34

🌟 At CreditHive, People Come First! 🌟 We believe that when you empower your employees, you unlock the true potential of your business. From flexible work culture to open-door leadership, from upskilling opportunities to celebrating every small win — CreditHive is proud to be an employee-centric workplace. Here’s what makes our culture stand out: 💼 Ownership & Autonomy – We trust our teams and give them space to innovate 🤝 Collaboration Over Hierarchy – Ideas flow freely, and every voice is heard 📈 Career Growth – Regular training, mentorship, and performance rewards 🧠 Wellbeing Matters – We prioritize mental health and work-life balance 🎉 Celebrating Our People – Birthdays, milestones, achievements — we celebrate them all! We’re building more than a fintech company — we’re building a community of passionate, driven individuals who are changing lives across Africa through financial inclusion. 🌍💙 📢 Looking to be a part of a purpose-driven team? Join us at www.credithive.co.uk {hashtag|#|CreditHiveCulture} {hashtag|#|EmployeeFirst} {hashtag|#|FintechWithPurpose} {hashtag|#|LifeAtCreditHive} {hashtag|#|PeopleFirst} {hashtag|#|AfricanFintech} {hashtag|#|CareerWithImpact} {hashtag|#|WorkplaceWellbeing}

CreditHive - Easy Smartphone Credit

2025-06-09 11:57:52

Smart. Simple. Seamless — The CreditHive App Journey At CreditHive, we believe access to credit should be simple and stress-free, especially for underserved communities across Africa. That’s why we built a mobile-first experience that’s: ✅ Quick to apply — Complete your application in minutes ✅ Easy to track — Get real-time EMI reminders & payment status ✅ Flexible to use — Choose repayment options that suit your budget ✅ Safe & secure — Your data and devices are always protected 💡 From onboarding to owning a smartphone — everything happens inside the app. 📈 With thousands of successful journeys and growing repayment rates, CreditHive is setting a new benchmark in inclusive fintech. 📩 Want to explore partnerships or invest in scaling this impact? Let’s connect → www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|UserJourney} {hashtag|#|FintechForAfrica} {hashtag|#|InclusiveFinance} {hashtag|#|MobileCredit} {hashtag|#|TechForGood} {hashtag|#|AfricaFintech} {hashtag|#|CustomerFirst} {hashtag|#|SmartphoneFinancing} {hashtag|#|InvestorOpportunity}

CreditHive - Easy Smartphone Credit

2025-06-04 20:46:41

Smart Credit, Smarter Growth We don’t just offer financing — we build financial identities. With every paid installment, a CreditHive customer is building a profile that could unlock: ✅ Future credit ✅ Better job opportunities ✅ Digital access In the last 6 months alone: 📌 Opened new stores in Zambia, Ghana & DRC 📊 Achieved 2x growth in on-time repayments 🤝 Partnered with leading telcos and agents Our AI-powered psychometric models go beyond paperwork to assess potential. We’re turning unbanked populations into digitally empowered consumers. 💬 Let’s collaborate to bring smart credit access to the next 10 million users. {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|ImpactInvestment} {hashtag|#|CreditScoring} {hashtag|#|InclusiveFinance}

CreditHive - Easy Smartphone Credit

2025-05-30 13:18:37

🌍 Bridging Africa’s Digital Divide: Trusted fintech partner CreditHive Africa is on the brink of a digital transformation boom, and smartphone access is the key. CreditHive is positioned to be the trusted fintech partner to scale across underserved markets — and investors can fuel that growth. Across Africa, over 600 million people remain unbanked and nearly half the population lacks reliable access to digital tools. This digital gap is more than a connectivity issue — it’s a barrier to education, employment, financial inclusion, and long-term economic growth. At CreditHive, we’re not just providing smartphones — we’re unlocking opportunity. 🚀 Our Mission: Enable Africa’s unbanked population to access smartphones through flexible, secure, and innovative Buy Now, Pay Later solutions — without needing a traditional credit history. 💡 Why CreditHive is Investable: • ✅ Proven Model across Zimbabwe,Zambia, Ghana, DRC & more • 📊 Consistent Growth: High on-time repayment rates & rising smartphone penetration • 🧠 Smart Credit Profiling using psychometric analysis and alternative data • 📲 Scalable Technology with mobile-first onboarding, KYC & loan management • 🤝 Strong Local Partnerships with telecoms, agents, and community leaders 🌱 The Impact: • 70%+ of CreditHive users are first-time smartphone owners • 60%+ use devices for income generation or education • Thousands of customers now have a digital identity and credit footprint for the first time Let’s work together to bridge the digital divide — and unlock the next frontier of economic inclusion in Africa. 🔗 www.credithive.co.uk 📩 DM us to learn how you can be part of Africa’s digital revolution. {hashtag|#|CreditHive} {hashtag|#|AfricaRising} {hashtag|#|ImpactInvestment} {hashtag|#|FintechAfrica} {hashtag|#|DigitalInclusion} {hashtag|#|InvestorOpportunity} {hashtag|#|FinancialInclusion} {hashtag|#|SmartphoneFinancing} {hashtag|#|TechForGood} {hashtag|#|Ghana} {hashtag|#|Zambia} {hashtag|#|DRC} {hashtag|#|EmergingMarkets}

CreditHive - Easy Smartphone Credit

2025-05-23 17:21:24

🚀 Reimagining Access for Africa’s Unbanked. One Device at a Time. 🌍📱 In a world that runs on digital access, owning a smartphone isn't just about communication — it's about participation. At CreditHive, we’re building the rails to ensure millions of unbanked Africans are no longer left behind. 🔓 No credit history? 📝 No paperwork? 💳 No problem. Using alternative credit scoring models and psychometric analysis, we’re enabling everyday individuals — street vendors, students, gig workers, farmers — to finance a smartphone with dignity and zero dependence on traditional banking systems. ✨ What does this mean on the ground? A mother in Zambia now runs a mobile money kiosk from her phone A student in Ghana attends online classes regularly A boda driver in DRC accepts digital payments and boosts his income Thousands of users across Africa are now first-time digital borrowers with repayment success We're not just selling devices. We're: ✅ Building first-time credit identities ✅ Creating digital citizens ✅ Opening doors to microloans, e-learning, job access, and more 📢 To investors and telecom operators: The future of financial inclusion doesn’t sit in a boardroom. It rides on the backs of real people with untapped potential — and we’re already on the ground, making it happen. Let’s scale this vision. Together. 🌱 👉 www.credithive.co.uk {hashtag|#|AfricaUnbanked} {hashtag|#|FintechImpact} {hashtag|#|CreditHive} {hashtag|#|InclusiveInnovation} {hashtag|#|TechWithPurpose} {hashtag|#|InvestorReady} {hashtag|#|TelecomPartnerships} {hashtag|#|FinancialInclusion} {hashtag|#|NextBillion} {hashtag|#|SmartphoneAccess}

CreditHive - Easy Smartphone Credit

2025-05-15 15:42:33

Market Storming in Ghana – CreditHive Is Here! 📲 Team CreditHive is hitting the streets of Ghana with one mission — bringing affordable smartphones to everyone! We're out in your local markets, communities, and bus stations to help people: ✅ Own your dream smartphone with Buy Now, Pay Later ✅ Get approved with NO bank account needed ✅ Just bring your ID & a smile – we'll handle the rest! 💬 Why wait? You can now stay connected, grow your business, or study online – all with a smartphone you can afford. 👥 Look out for our CreditHive Team – we’re here to answer your questions, register you instantly, and get you started! Let’s make technology accessible for all. One phone. One opportunity. One Ghana. 🔗 www.credithive.co.uk

CreditHive - Easy Smartphone Credit

2025-05-06 18:46:28

🌟 Empowering Ghana, One Handset at a Time! 📱 This Good Friday, we’re not just celebrating — we’re empowering! 💪 Team CreditHive Ghana is on the ground in the Western Region, driving a special sales campaign that will make affordable smartphone ownership more accessible to more people than ever before. Team CreditHive Ghana is on the ground in the Western Region, driving a special sales campaign that will make affordable smartphone ownership more accessible to more people than ever before. ✨ Our Mission: Make technology accessible by helping every hardworking individual own their dream smartphone through simple, flexible Buy Now, Pay Later options. No bank account? No problem. No complex paperwork. Just real solutions for real people. 🔗 We’re here to bridge the gap between desire and affordability — giving people the power to connect, grow, and succeed. Let’s build a more inclusive future, together. {hashtag|#|CreditHiveGhana} {hashtag|#|FinancialInclusion} {hashtag|#|BuyNowPayLater} {hashtag|#|SmartphoneForAll} {hashtag|#|GhanaGrowth} {hashtag|#|InclusiveTech} {hashtag|#|WesternRegionGhana} {hashtag|#|GoodFridayImpact} {hashtag|#|EmpowerThroughAccess} {hashtag|#|AfricaFintech}

CreditHive - Easy Smartphone Credit

2025-04-30 14:55:55

CreditHive’s Zambia Expansion: Scaling Impact, Unlocking Opportunity 🇿🇲📈 At CreditHive, we believe that access to technology is the first step toward economic empowerment. Today, we are proud to share the tremendous growth of our operations in Zambia: ✨ Rapid Customer Growth — Thousands of new users have embraced CreditHive’s easy, secure smartphone financing. ✨ High Repayment Rates — Improved customer profiling and KYC processes have strengthened portfolio quality. ✨ Strategic Regional Expansion — New territories activated with robust partner ecosystems and field teams. ✨ Technology-Driven Scalability — Our seamless mobile onboarding and credit profiling engine is scaling across markets with minimal operational overhead. 🔹 Why it Matters for Investors: Proven model delivering measurable financial inclusion Strong demand from underbanked markets Sustainable growth with positive customer behavior patterns Opportunity for regional dominance in the African fintech market As we continue to grow, we are actively seeking visionary partners and investors to help us accelerate our mission across Africa. 🌟 Let’s build the future of financial access together. 📩 Connect with us at www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|ZambiaGrowth} {hashtag|#|FintechInvestment} {hashtag|#|FinancialInclusion} {hashtag|#|ImpactInvestment} {hashtag|#|ScalingInnovation} {hashtag|#|SmartphoneFinancing} {hashtag|#|AfricaFintech} {hashtag|#|InvestorOpportunity} {hashtag|#|TechForGood} {hashtag|#|FutureOfFinance}

CreditHive - Easy Smartphone Credit

2025-04-25 11:22:30

🚀 Big News from DRC Congo! 🇨🇩📱 We’re thrilled to announce the launch of 4 brand-new CreditHive partner stores across the Democratic Republic of Congo! This marks another big step in our mission to make affordable smartphone financing accessible to everyone — especially the unbanked. 💡 What this means: ✅ More reach, more convenience for our customers ✅ Stronger local presence with trusted telecom partners ✅ Empowering communities with digital access and financial inclusion Whether you're an entrepreneur, student, or professional — now it’s even easier to walk into a store, choose your dream device, and walk out connected with a flexible payment plan. 🔗 Learn more: www.credithive.co.uk A huge thank you to our partners Africell & Orange, and to our growing CreditHive family in DRC. The journey continues! 🌍💙 {hashtag|#|CreditHive} {hashtag|#|FinancialInclusion} {hashtag|#|SmartphoneFinancing} {hashtag|#|DigitalAccess} {hashtag|#|DRCCongo} {hashtag|#|TelecomPartnership} {hashtag|#|Africell} {hashtag|#|Orange} {hashtag|#|Fintech} {hashtag|#|Growth} {hashtag|#|TechForGood}

CreditHive - Easy Smartphone Credit

2025-04-21 17:16:30

📱 Empowering Dreams, One Device at a Time! 🌍 At CreditHive, we believe everyone deserves access to the digital world. Whether you're a student, a professional, or a small business owner, we make it easy for you to own a smartphone today and pay later — on your terms. 💸✅ 📍 Serving communities across Africa 🔐 Safe. Simple. Affordable. 🤝 Trusted by thousands Join the hive. Experience the freedom of mobile financing made for you. ➡ Learn more: www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|EmpowerWithTech} {hashtag|#|SmartFinancing} {hashtag|#|PayLaterOwnNow} {hashtag|#|DigitalAfrica}

CreditHive - Easy Smartphone Credit

2025-04-16 12:49:09

Seamless Tech. Real Impact. At CreditHive , technology isn’t just a feature — it’s the backbone of our mission to make smartphone financing accessible to everyone. Here’s how our tech is transforming lives across Africa: Instant eKYC & Onboarding From store to screen in minutes — our app ensures paperless, secure verification using national ID and facial recognition. Smartphone Lock Technology Built-in integration ensures devices stay secure until payments are complete — protecting both customers and partners. Real-Time Credit Profiling Our AI-driven engine analyzes behavioral and telecom data to make instant credit decisions, even for those with no banking history. Integrated Payments & Tracking Fully integrated with mobile money platforms like EcoCash, MTN, Airtelmoney making collections seamless and reconciliations effortless. Field Agent Access Our mobile-first platform empowers on-ground agents with tools for document uploads, customer photos, and live order tracking. We’re not just building fintech. We’re building trust, access, and opportunity — powered by technology. 🚀 Want to partner with us to drive financial inclusion? 👉 www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|FintechForGood} {hashtag|#|FinancialInclusion} {hashtag|#|Unbanked} {hashtag|#|SmartphoneFinancing} {hashtag|#|SeamlessTech} {hashtag|#|AfricaTech} {hashtag|#|MobileFinance} {hashtag|#|eKYC} {hashtag|#|FintechAfrica} {hashtag|#|DigitalInclusion} {hashtag|#|SmartTechForChange}

CreditHive - Easy Smartphone Credit

2025-04-10 12:45:52

Month-on-Month Growth at CreditHive – A Testament to Financial Inclusion 📈 We’re excited to share that CreditHive has witnessed consistent month-on-month growth in smartphone financing sales across all our operating regions! 🌍📱 🔹 Why this matters? Our growth reflects: ✅ Rising demand for affordable, accessible mobile financing ✅ Growing trust among unbanked and underserved populations ✅ Strong partnerships with telcos and retail networks ✅ Our scalable credit profiling and eKYC system 💡 With every smartphone financed, we’re not just selling a device — we’re unlocking digital access, financial identity, and economic opportunity for thousands. 🎯 This momentum fuels our mission to bridge the digital divide and bring financial inclusion to the last mile. A big THANK YOU to our amazing team, field agents, and partners who make this possible every day. 📊 The journey has just begun — we’re only getting started! {hashtag|#|CreditHive} {hashtag|#|FintechForGood} {hashtag|#|FinancialInclusion} {hashtag|#|GrowthStory} {hashtag|#|ImpactFintech} {hashtag|#|SmartphoneFinancing} {hashtag|#|UnbankedAfrica} {hashtag|#|DigitalAccess} {hashtag|#|InvestorUpdate} {hashtag|#|MWC2025} {hashtag|#|AfricaRising} {hashtag|#|FintechGrowth}

CreditHive - Easy Smartphone Credit

2025-04-05 18:11:27

How Can You Thrive in a Digital World Without a Bank Account? In Africa, millions face this challenge every day. Without a financial history, access to credit is nearly impossible. 💡 Here’s the reality: 🚫 No credit history = No smartphone financing 🚫 No smartphone = No access to digital finance 🚫 No digital finance = No economic growth That’s where CreditHive steps in: 📲 Flexible smartphone financing without a bank account 🔍 Alternative credit assessment beyond traditional banking 🤝 Partnerships with top telecoms to expand digital access The result? More people empowered with financial tools to grow. 📩 Let’s work together to drive financial inclusion across Africa! {hashtag|#|FinancialInclusion} {hashtag|#|UnbankedAfrica} {hashtag|#|CreditHive} {hashtag|#|InvestInTech} {hashtag|#|AfricaFintech} {hashtag|#|SmartphoneForAll}

CreditHive - Easy Smartphone Credit

2025-04-01 16:35:51

Revolutionizing Credit Access with Smart Credit Profiling! At CreditHive, we believe financial inclusion starts with smart, data-driven credit decisions. Our Credit Profiling Model is designed to empower the unbanked population by providing accessible and reliable smartphone financing—without the need for traditional credit history. 🔹 How It Works? ✅ Alternative Data Analysis – Using mobile usage patterns, transaction behavior & digital footprints. ✅ AI-Powered Risk Assessment – Evaluating repayment potential with real-time insights. ✅ Instant Credit Offers – Personalized financing options tailored for each customer. 🔍 Why This Matters? 💳 Expanding Access – Enabling customers with no formal credit history to own a smartphone. 📈 Risk Mitigation – Ensuring responsible lending while fostering financial growth. 🌍 Empowering the Unbanked – Driving financial inclusion across Africa and beyond. With our advanced credit profiling model, we’re not just financing smartphones—we’re unlocking opportunities, connectivity, and a brighter financial future! {hashtag|#|CreditHive} {hashtag|#|FinancialInclusion} {hashtag|#|CreditProfiling} {hashtag|#|SmartphoneFinancing} {hashtag|#|AIinFintech} {hashtag|#|Unbanked} {hashtag|#|FintechInnovation} {hashtag|#|DigitalTransformation}

CreditHive - Easy Smartphone Credit

2025-03-28 13:35:22

Bridging the Financial Gap for Africa’s 350M+ Unbanked People 🌍📱 Did you know that *nearly 57% of adults in Africa* don’t have access to formal banking? That’s *350M+ people* left out of the financial system! ❌ No access to credit ❌ No formal financial history ❌ Limited opportunities for growth At CreditHive, we’re solving this with smartphone financing for the unbanked—empowering people to: ✅ Access digital financial services ✅ Build a financial footprint without a bank account ✅ Stay connected with affordable, flexible payment plans Financial inclusion isn’t just about banking—it’s about opportunity, connectivity, and economic growth. 🚀 Let’s empower Africa, one smartphone at a time! {hashtag|#|FinancialInclusion} {hashtag|#|UnbankedAfrica} {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|FintechForGood} {hashtag|#|AfricaRising}

CreditHive - Easy Smartphone Credit

2025-03-18 15:58:33

CreditHive: Over a Year of Empowering DRC Congo! 🇨🇩📱 We’re proud to celebrate over a year of making smartphone ownership easy in the Democratic Republic of Congo! 🚀 📡 In Partnership with Africell & Orange – helping thousands get affordable smartphones with flexible payment plans and hassle-free financing! ✨ Why Choose CreditHive? ✅ Own a smartphone with easy, flexible installments ✅ No bank account? No problem! Simple eKYC verification ✅ Stay connected with top networks like Africell & Orange 🔹 Whether you're an entrepreneur, student, or professional, CreditHive is here to keep you connected and financially empowered. 📍 Visit our partner stores or sign up today! 👉 www.credithive.co.uk {hashtag|#|CreditHive} {hashtag|#|DRCCongo} {hashtag|#|Africell} {hashtag|#|Orange} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|StayConnected} {hashtag|#|OneYearStrong}

CreditHive - Easy Smartphone Credit

2025-03-11 18:07:36

Milestone Unlocked at MWC 2025! 📱🎉 We’re excited to share that Creditihive has made big strides at MWC 2025! ✅ Streamlined Onboarding Process – Faster, easier smartphone financing for the unbanked. ✅ Enhanced Credit Profiling – Better insights to serve unbanked customers. ✅ Improved Product Delivery – Stronger partnerships for seamless financing solutions. Our time at MWC was all about collaborating with industry leaders — and we’re proud to say it’s already transforming our product delivery and accessibility. A big thank you to our partners and everyone who believes in financial inclusion. The journey has just begun! 💯📊 {hashtag|#|MWC2025} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|Creditihive} {hashtag|#|Partnerships} {hashtag|#|Unbanked} {hashtag|#|Onboarding} {hashtag|#|CreditProfiling}

CreditHive - Easy Smartphone Credit

2025-03-05 15:55:40

CreditHive is Live at MWC Barcelona 2025! 🌍📱 We’re thrilled to be at the world’s largest connectivity event—MWC Barcelona 2025! Join us as we showcase how smartphone financing is transforming digital and financial inclusion across Africa and beyond. 📍 Where to Find Us? 📅 March 3rd-6th, 2025 📍 Fira Gran Via, Barcelona 💡 Why Meet Us? ✅ Partner with us for smartphone financing solutions ✅ Learn how we enable financial inclusion for the unbanked ✅ Discover our innovative device financing model for telecom operators, OEMs, and fintechs 📩 If you're attending, let’s connect! Or DM us to schedule a meeting. {hashtag|#|MWC2025} {hashtag|#|CreditHive} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|Barcelona} {hashtag|#|Fintech} {hashtag|#|TelecomInnovation}

CreditHive - Easy Smartphone Credit

2025-02-28 14:54:45

CreditHive at MWC Barcelona 2025 – Partner with Us! 📱🌍 We’re bringing next-gen smartphone financing to MWC Barcelona 2025! As a leading fintech driving financial inclusion in Africa and emerging markets, we are looking for investors and telecom operators to expand our impact. Why Partner with CreditHive? ✅ Telecom Growth: Increase smartphone penetration and ARPU with device financing solutions tailored for unbanked customers. ✅ Investor Opportunity: A proven, scalable SaaS model powering financial inclusion with 140% growth and expansion into new markets. ✅ End-to-End Ecosystem: We provide technology, credit profiling, eKYC, risk management, and smartphone locking mechanisms to ensure seamless financing. ✅ Proven Success: Trusted by major telecoms and partners across Africa, Asia, and the Middle East. Let’s Connect at MWC Barcelona! 📅 Date: 3rd to 6th March 2025 📍 Location: Fira Gran Via, Barcelona 🎤 Meet Our Leadership: Chetan Dogra, Director CreditHive We are changing the game in smartphone financing, and we want you to be part of this journey! Let’s collaborate to drive digital and financial inclusion. 📩 DM us to schedule a meeting! {hashtag|#|CreditHive} {hashtag|#|MWC2025} {hashtag|#|TelecomPartnerships} {hashtag|#|SmartphoneFinancing} {hashtag|#|FinancialInclusion} {hashtag|#|InvestInAfrica} {hashtag|#|FintechInnovation} {hashtag|#|MobileGrowth}

CreditHive - Easy Smartphone Credit

2025-02-26 20:09:35

📢 CreditHive x MWC 2025: Let’s Talk Business! We’re excited to showcase how CreditHive is changing lives with smartphone financing solutions. Our plug-and-play fintech platform is helping telecom operators, microfinance companies, and OEMs reach unbanked customers like never before. At MWC Barcelona 2025, let’s discuss: 🔹 Strategic Investments in Africa’s fast-growing mobile financing market 🔹 Partnerships with Telecom & Microfinance Leaders 🔹 How Smartphone Financing Drives Financial Inclusion 📅 Meet us on 3rd March to 6th March in Barcelona! 📩 Schedule a meeting with us at cd@mobihivelabs.com {hashtag|#|MWC2025} {hashtag|#|CreditHive} {hashtag|#|FintechForAfrica} {hashtag|#|SmartphoneFinancing} {hashtag|#|InvestWithUs} {hashtag|#|FinancialInclusion} {hashtag|#|MobileTechnology}

CreditHive - Easy Smartphone Credit

2025-02-17 18:51:16

🚀 Exciting News from CreditHive! 🚀 We’re heading to MWC 2025 Barcelona, the world’s premier stage for mobile innovation! 📅 3rd – 6th March | 📍 Fira Gran Via, Barcelona We’re redefining smartphone financing & financial inclusion across emerging markets. 💡 Why It Matters: ✔ Unlocking fintech & digital lending opportunities ✔ Empowering unbanked communities with mobile financing ✔ Driving scalable growth in Africa & beyond 📍 Attending MWC 2025? Let’s connect & shape the future of fintech! Schedule a meeting today. {hashtag|#|MWC2025} {hashtag|#|CreditHive} {hashtag|#|FintechInnovation} {hashtag|#|SmartphoneFinancing}